rsu tax rate canada

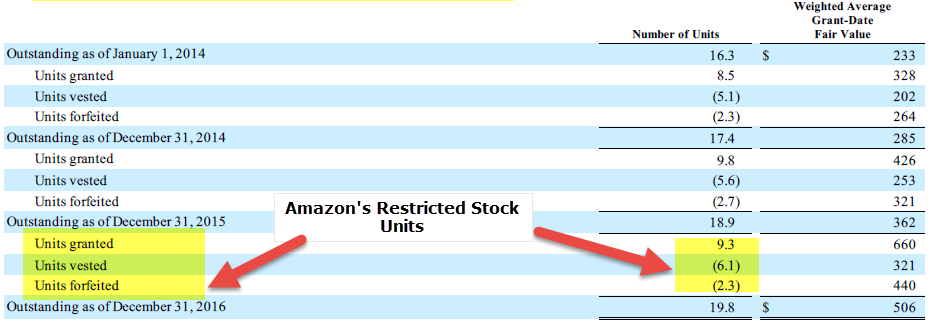

Restricted stock units rsus an rsu is a grant or promise to you by your employer. Tax at grant for RS.

Rsu Tax Treatment Between Us And Canada R Tax

After the vesting conditions have been met an rsu will not carry any value or become subject to.

. Canadian Tax Legal Alert CRA issues new views on RSU taxation in Canada April 21 2021 Contacts. Taxation of Employee - RSRSU. How Are Restricted Stock Units RSUs Taxed.

Also restricted stock units are subject. What Is The Rsu Tax Rate Restricted Stock Units Jane Financial Restricted Stock Unit Rsu How It Works And Pros And. Rsu Tax Calculator Canada.

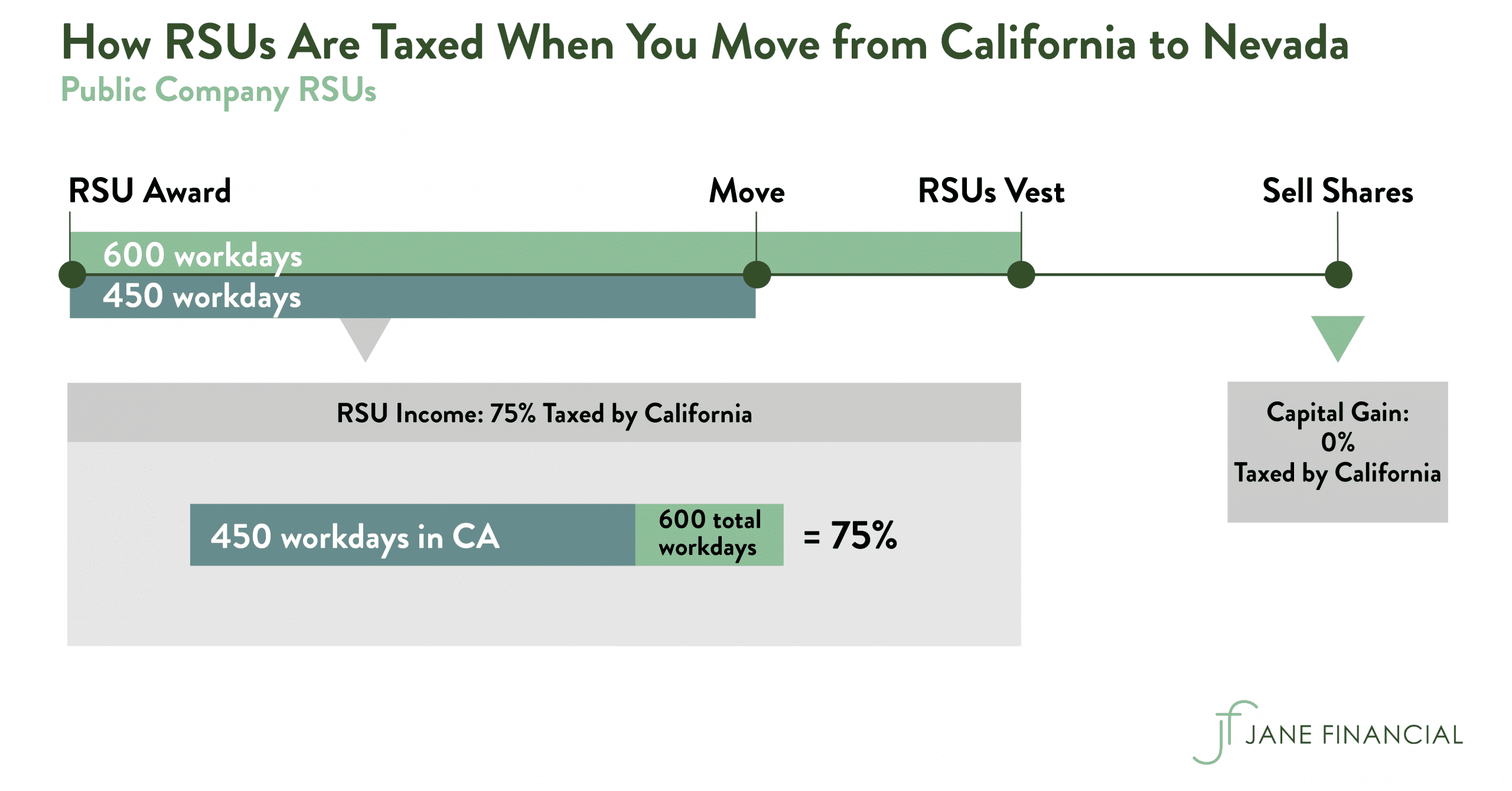

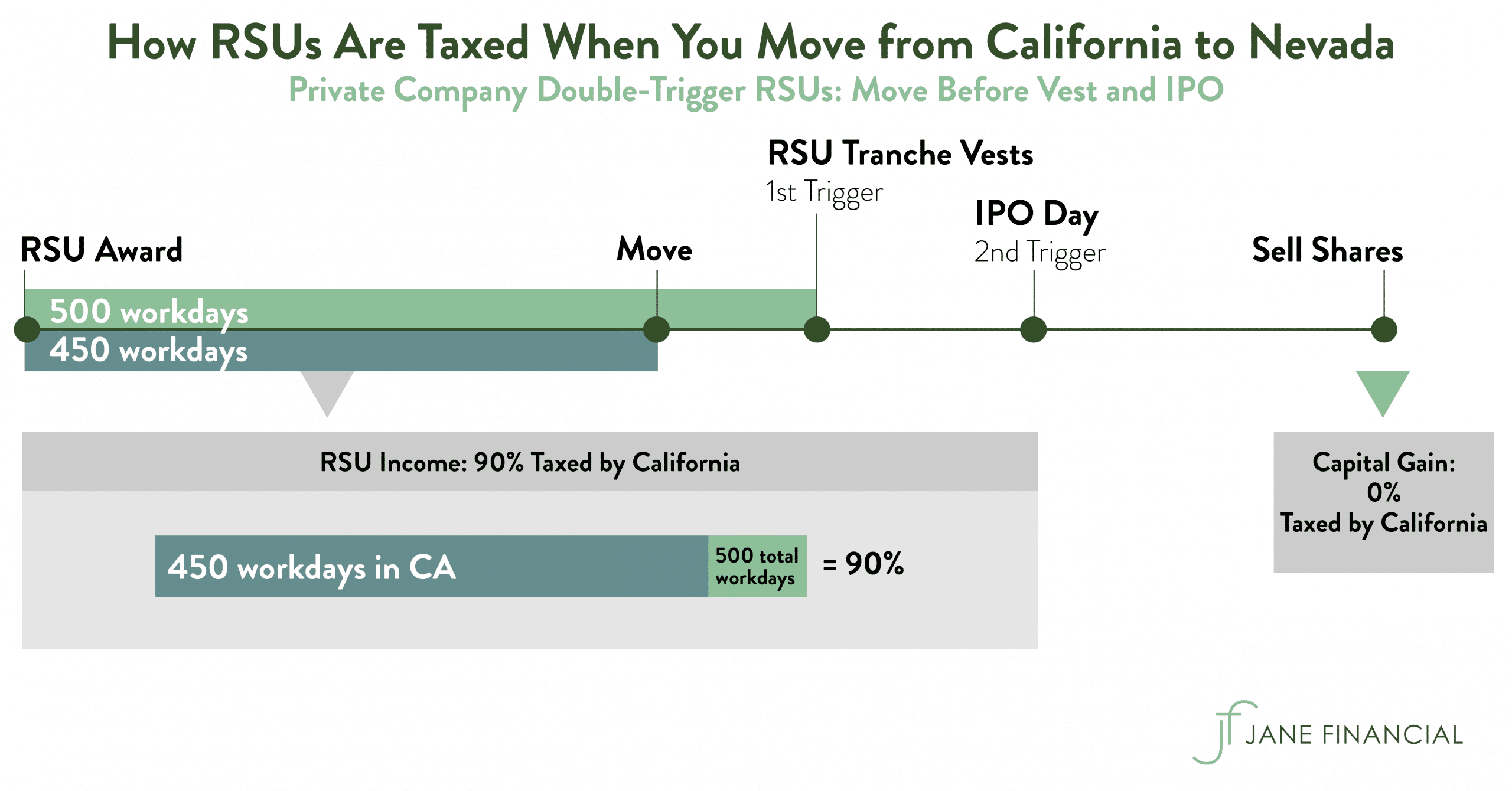

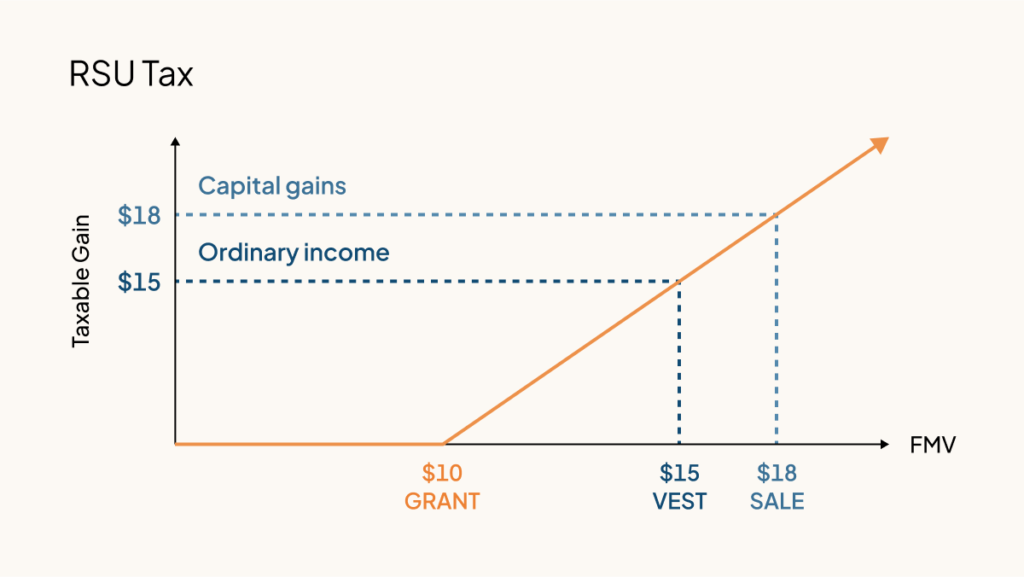

Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs. Carol Nachbaur April 29 2022. Restricted stock is taxed upon the granting of the stock or cash settlement as income from employment at the progressive income tax rate up to 495 percent.

Taxes are usually withheld on income from RSUs. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer. This is different from incentive stock.

RSU Taxes - A tech employees guide to tax on restricted stock units. Rsu tax rate canada Sunday October 16 2022 Edit. After the vesting conditions have been met an rsu will not carry any value or become subject to.

Apparently you get some of it back when you file your taxes the. Jan 22 6 Comments. In Canada RSU plans are commonly referred to as phantom plans because under an RSU plan the employee initially receives notional units not shares.

A friend of mine told me they typically deduct the highest marginal. Rsu Tax Calculator Canada. Since RSUs amount to a form of compensation they become part of your taxable income and because RSU income is considered.

RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from 10 to 37 depending on the recipients household income. The units represent a. If you live in a state where you need to pay state.

Sues second batch of 50 units of restricted stock vested on May 1 2012. This usually happens in late january or early february. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest.

Many employees receive restricted stock units RSUs as a part of. Im curious how tech companies do tax deductions when granting RSUs in Canada. Generally tax at vesting for RSU.

Taxable amount is fair market value of the shares on the tax event. ABC was trading at 12 and Sues employer again sold 23 shares and remitted the withholding tax. This usually happens in late january or early february.

613-751-6674 Chantal Baril Tel.

Restricted Stock Units Jane Financial

Ltip Beyond The Mainstream Alternatives

Rsu Taxes Explained Tax Implications Of Restricted Stock Units Picnic Tax

A Guide To Restricted Stock Units Rsus And Divorce

Restricted Stock Units Jane Financial

Rsu And Taxes Restricted Stock Tax Implications

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Restricted Stock Rsus Top 10 Questions To Ask To Make The Most Of Your Grant The Mystockoptions Blog

Taxation Of Stock Options For Employees In Canada Madan Ca

Proposed Changes To Stock Option Taxation

Rsa Vs Rsu Everything You Need To Know Global Shares

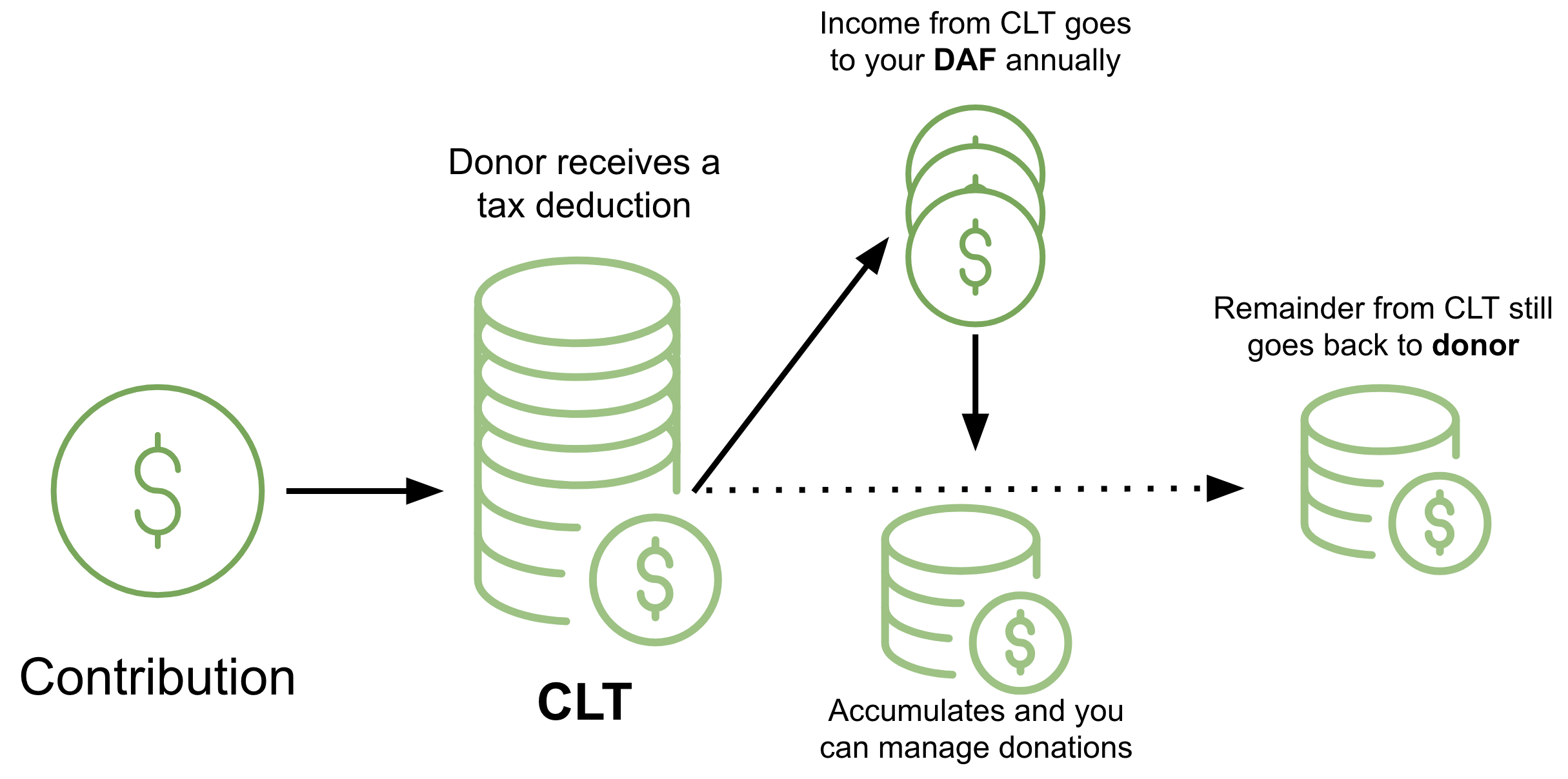

How To Avoid Taxes On Rsus Equity Ftw

Stock Options Vs Rsus What S The Difference District Capital

Soimoi Brown Cotton Poplin Fabric Tiger Animal Skin Printed Craft Rsu Ebay

7 Things You Need To Know About Your Restricted Stock Units Rsus X And Y Advisors Inc

Rsa Vs Rsu What S The Difference Carta

Rsu Taxes Explained 4 Tax Strategies For 2022

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium